Just amplifying what Rog has said in his post Getting the message.

As I have discussed previously, the Health Care Worker (HCW) market in the US is strategic for the uptake of QuantiFERON-TB Gold as a replacement for the TST. This data (and the comments by HCWs) clearly shows that the trend is moving strongly towards a preference of QFT for the diagnosis of Latent TB in this important market.

Whilst I would not call this a "tipping point" (for that we want to see an actual sales volume spike), I would suggest that this is a seminal event.

Wednesday, March 31, 2010

Thursday, March 25, 2010

Canada "Mounts" the Case for QuantiFERON.

Get it? Canada - Mounts - Mounties? Oh well. I really wish I had Rogs ability to come up with witty and pithy headings.

Anyway, today Canada are holding their 7th Tuberculosis Conference in Alberta. (25th and 26th March). See here.

There are two very interesting presentations that will be made regarding the use of IGRAs for the diagnosis of TB in Canada.

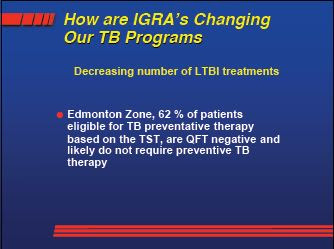

Interferon Gamma Release Assays: What’s new & How are IGRAs changing our programs

This is a very positive presentation for the adoption of IGRAs (specifically QFT) in Canada. It seems from the presentation that Canada is a little behind the USA in its move to IGRA testing but the message of the presentation seems clear - they need to get their skates on.

Of particular interest are the results from Chan that I don't recall having seen previously. Basically it once again demonstrates the spectacular specificity of QFT compared to TST.

School Screening Program Review

This presentation examines the results of using QFT in the Alberta School District with a view to establishing the lack of specificity of the TST that is currently used for screening.

Anyway, today Canada are holding their 7th Tuberculosis Conference in Alberta. (25th and 26th March). See here.

There are two very interesting presentations that will be made regarding the use of IGRAs for the diagnosis of TB in Canada.

Interferon Gamma Release Assays: What’s new & How are IGRAs changing our programs

This is a very positive presentation for the adoption of IGRAs (specifically QFT) in Canada. It seems from the presentation that Canada is a little behind the USA in its move to IGRA testing but the message of the presentation seems clear - they need to get their skates on.

Of particular interest are the results from Chan that I don't recall having seen previously. Basically it once again demonstrates the spectacular specificity of QFT compared to TST.

School Screening Program Review

This presentation examines the results of using QFT in the Alberta School District with a view to establishing the lack of specificity of the TST that is currently used for screening.

Wednesday, March 24, 2010

It's all about Progression.

I think I finally have managed to put the pieces together to really understand what this whole thing is about. (It has only taken me 9 or so years to get to this point!). It's a bit complex so I hope I can translate the thoughts in my head into the written word in a way that makes sense.

Let's start with a little diversion.

Cellestis' corporate motto is "Changing the way the world looks at TB" I'm sure we've all seen this on their website and documentation. Perhaps we've even thought that it's a pretty good motto. But look at it very closely and you can see that there are two messages contained in that one little precise statement. Firstly we can substitute the reasonably close synonym of "diagnoses" for the phrase "looks at". That is, to diagnose something, one would "look at" it. So the motto is saying "Changing the way the world diagnoses TB"

However, the motto says something else as well. Just take the whole message as it is written. They are saying that they are changing the way that TB people actually understand TB. The QuantiFERON TB Gold diagnostic is doing more than just providing a new way of diagnosing TB - it is actually changing the dynamics of this whole field of endeavor. It is this second meaning that I believe is of huge importance.

Naively, when I first became involved in this my thoughts were along the line of "Well, the existing test is not very good, QuantiFERON-TB is demonstrably much better. Just replace the existing (TST) test with QuantiFERON-TB. Job done". Both from the evidence (10 years!) and the knowledge that I (we?) have gained, it is now clear that that was truly naive and incorrect. It's not that simple. In the following I hope that I can explain both why that is so and, more importantly (even though we have been waiting for 10 years), the positives for us of the real situation.

We know that QFT-TB Gold has at least as high a sensitivity as the TST and, most importantly, a much higher specificity (ability to not report false positives). I have said much about this in the past but it has primarily always been from the perspective of patient outcomes and the costs of current TB programs. That is, the low specificity of the TST results in huge numbers of people being treated with (quite nasty) antibodies when they weren't actually infected. This treatment comes at a financial cost to the TB program (both the cost of the actual treatment and the cost of monitoring same).

In the rest of this discussion I will rely heavily upon the following findings of Diel.

The implementation of medicine is impacted by the cost of achieving outcomes as much as it is about pure patient outcomes. This may, at first thought, seem a slightly sad situation but it really doesn't take much thought to see why it is so and always will be so.

In the specific field of TB control there is much consideration of the cost of achieving outcomes. The current TB control programs implemented around the world (as different as each may be) have been developed to utilize financial resources in the most efficient way (at least we would hope that is the case).

Let's take the (slightly unscientific) step of assuming that the results of the Diel paper above apply universally. We know that that is probably not the case and different studies with different population groups may find different results. However, whilst the metric of the differences between TST and QFT may vary, the principles below will hold true.

The results of the Diel paper are:

- QFT did not miss a single case of latent TB (as defined by progression to Active TB within 2 years) whereas TST missed one. (that's sensitivity). This is good (for QFT) but more importantly (in the context of this post);

- 1 in 6 (14.6%) of the QFT positives went on to develop Active TB within 2 years, whereas only 2.3% of TST positives did so. Thats specificity as elicited by Progression.

Note that those results were over a two year period. Common wisdom (and you know that I dislike "common wisdom") says that the chances of progressing from latent TB to active TB are greatest in the first 2 years after exposure. True? Untrue? I'm not sure and I will do a separate post on that issue at another time, rather than distracting from the aim of this post.

Let's try to be very targeted with our thinking here. To do that forget about the sensitivity issue - let's forge ahead even assuming that TST is as sensitive as QFT (it's clearly not but it involving it in this discussion would make the argument more difficult to clearly fix in our heads - well, mine, anyway). So, we are talking purely about specificity or, more specifically (!), Progression.

Remember that we said that TB Control Programs are impacted by costs - actually "cost/reward". Complex costing models involving the cost of diagnosis, the cost of treatment and the cost of having potential TB patients wandering around the community will impact exactly how a TB Control Program is implemented. We are getting close to the nuts and bolts of this now. Implementing QuantiFERON TB Gold diagnosis totally changes those costing models and therefore the content, implementation and value of TB Control Programs. (That is my take home message).

Using the Diel results, we know that of the 601 contacts, 66 (11%) were diagnosed as having latent TB by QFT, whereas 243 (40%) were diagnosed as having latent TB by TST. Of the 66 diagnosed by QFT, 6 subsequently progressed to Active TB, whereas of the 243 TST positives only 5 (2.3%) progressed to Active TB. It is patently obvious that when you factor those figures into the costing model of a TB Control Program, the program will change completely. Suddenly, in at least some circumstances, the costs of not testing (and leaving potential TB vectors in the community) becomes a higher relative cost than testing. Or, in really simple terms, whereas it may be that under a low progression regime (TST) it may not be financially efficient to test certain populations in certain situations, if your diagnostic (QFT) has a much higher progression rate then it becomes financially effective to diagnose that population.

Suddenly, armed with this new tool, those who manage TB Control Programs have the opportunity (even necessity?) to reshape their programs to achieve better outcomes at a lower cost (as Dr. Masae Kawamura seems to have implemented in San Francisco).

It's a huge thing. Whilst CST are making ever growing sales into the current scenario, in time (and the CDC Guidelines will provide impetus to this), I believe that we will see these changes to TB Control Programs happen. Ultimately, it may even mean that more more people will be tested and/or existing testing regimes will be performed more frequently.

Cellestis - Changing the way the world looks at TB.

Let's start with a little diversion.

Cellestis' corporate motto is "Changing the way the world looks at TB" I'm sure we've all seen this on their website and documentation. Perhaps we've even thought that it's a pretty good motto. But look at it very closely and you can see that there are two messages contained in that one little precise statement. Firstly we can substitute the reasonably close synonym of "diagnoses" for the phrase "looks at". That is, to diagnose something, one would "look at" it. So the motto is saying "Changing the way the world diagnoses TB"

However, the motto says something else as well. Just take the whole message as it is written. They are saying that they are changing the way that TB people actually understand TB. The QuantiFERON TB Gold diagnostic is doing more than just providing a new way of diagnosing TB - it is actually changing the dynamics of this whole field of endeavor. It is this second meaning that I believe is of huge importance.

Naively, when I first became involved in this my thoughts were along the line of "Well, the existing test is not very good, QuantiFERON-TB is demonstrably much better. Just replace the existing (TST) test with QuantiFERON-TB. Job done". Both from the evidence (10 years!) and the knowledge that I (we?) have gained, it is now clear that that was truly naive and incorrect. It's not that simple. In the following I hope that I can explain both why that is so and, more importantly (even though we have been waiting for 10 years), the positives for us of the real situation.

We know that QFT-TB Gold has at least as high a sensitivity as the TST and, most importantly, a much higher specificity (ability to not report false positives). I have said much about this in the past but it has primarily always been from the perspective of patient outcomes and the costs of current TB programs. That is, the low specificity of the TST results in huge numbers of people being treated with (quite nasty) antibodies when they weren't actually infected. This treatment comes at a financial cost to the TB program (both the cost of the actual treatment and the cost of monitoring same).

In the rest of this discussion I will rely heavily upon the following findings of Diel.

Title: Predictive value of a whole blood IFN-gamma assay for the development of active tuberculosis disease after recent infection with Mycobacterium tuberculosis.

Authors: Diel R, Loddenkemper R, Meywald-Walter K, Niemann S, Nienhaus A

Journal: Am. J. Respir. Crit. Care Med.

Publication Date: Volume 177 - Issue 10 - May-2008

PubMedID: 18276940

RATIONALE: Numerous studies have been published on the new Mycobacterium tuberculosis (MTB)-specific IFN-gamma release assays. However, their prognostic value for progression from latent tuberculosis infection (LTBI) to active TB has yet to be established. OBJECTIVES: To compare the QuantiFERON-TB Gold In-Tube assay (QFT) with the tuberculin skin test (TST) in recently exposed close contacts of active TB cases with respect to their development of TB disease within 2 years. METHODS: Close contacts (n = 601) of MTB-positive source cases underwent both TST and QFT testing and were subsequently observed for 103 (+/-13.5) weeks. Risk factors for MTB infection were evaluated by multivariate analysis. MEASUREMENTS AND MAIN RESULTS: For the TST, 40.4% (243/601) of contacts were positive at a 5-mm cutoff, whereas only 66 (11%) were QFT positive. QFT positivity, but not TST, was associated with exposure time (P < 0.0001). Six contacts progressed to TB disease within the 2-year follow-up. All were QFT positive and had declined preventive treatment, equating to a progression rate of 14.6% (6/41) among those who were QFT positive. The progression rate for untreated TST-positive subjects was significantly lower (P < 0.003), at 2.3% (5 of 219), and one subject who progressed was TST negative. CONCLUSIONS: Results suggest that QFT is a more accurate indicator of the presence of LTBI than the TST and provides at least the same sensitivity for detecting those who will progress to active TB. The high rate of progression to active TB of those who are QFT positive (14.6%), which is far greater than the 2.3% found for those who are TST positive, has health and economic implications for enhanced TB control, particularly if this higher progression rate is seen in studies of other at-risk populations.It's all about Progression.

The implementation of medicine is impacted by the cost of achieving outcomes as much as it is about pure patient outcomes. This may, at first thought, seem a slightly sad situation but it really doesn't take much thought to see why it is so and always will be so.

In the specific field of TB control there is much consideration of the cost of achieving outcomes. The current TB control programs implemented around the world (as different as each may be) have been developed to utilize financial resources in the most efficient way (at least we would hope that is the case).

Let's take the (slightly unscientific) step of assuming that the results of the Diel paper above apply universally. We know that that is probably not the case and different studies with different population groups may find different results. However, whilst the metric of the differences between TST and QFT may vary, the principles below will hold true.

The results of the Diel paper are:

- QFT did not miss a single case of latent TB (as defined by progression to Active TB within 2 years) whereas TST missed one. (that's sensitivity). This is good (for QFT) but more importantly (in the context of this post);

- 1 in 6 (14.6%) of the QFT positives went on to develop Active TB within 2 years, whereas only 2.3% of TST positives did so. Thats specificity as elicited by Progression.

Note that those results were over a two year period. Common wisdom (and you know that I dislike "common wisdom") says that the chances of progressing from latent TB to active TB are greatest in the first 2 years after exposure. True? Untrue? I'm not sure and I will do a separate post on that issue at another time, rather than distracting from the aim of this post.

Let's try to be very targeted with our thinking here. To do that forget about the sensitivity issue - let's forge ahead even assuming that TST is as sensitive as QFT (it's clearly not but it involving it in this discussion would make the argument more difficult to clearly fix in our heads - well, mine, anyway). So, we are talking purely about specificity or, more specifically (!), Progression.

Remember that we said that TB Control Programs are impacted by costs - actually "cost/reward". Complex costing models involving the cost of diagnosis, the cost of treatment and the cost of having potential TB patients wandering around the community will impact exactly how a TB Control Program is implemented. We are getting close to the nuts and bolts of this now. Implementing QuantiFERON TB Gold diagnosis totally changes those costing models and therefore the content, implementation and value of TB Control Programs. (That is my take home message).

Using the Diel results, we know that of the 601 contacts, 66 (11%) were diagnosed as having latent TB by QFT, whereas 243 (40%) were diagnosed as having latent TB by TST. Of the 66 diagnosed by QFT, 6 subsequently progressed to Active TB, whereas of the 243 TST positives only 5 (2.3%) progressed to Active TB. It is patently obvious that when you factor those figures into the costing model of a TB Control Program, the program will change completely. Suddenly, in at least some circumstances, the costs of not testing (and leaving potential TB vectors in the community) becomes a higher relative cost than testing. Or, in really simple terms, whereas it may be that under a low progression regime (TST) it may not be financially efficient to test certain populations in certain situations, if your diagnostic (QFT) has a much higher progression rate then it becomes financially effective to diagnose that population.

Suddenly, armed with this new tool, those who manage TB Control Programs have the opportunity (even necessity?) to reshape their programs to achieve better outcomes at a lower cost (as Dr. Masae Kawamura seems to have implemented in San Francisco).

It's a huge thing. Whilst CST are making ever growing sales into the current scenario, in time (and the CDC Guidelines will provide impetus to this), I believe that we will see these changes to TB Control Programs happen. Ultimately, it may even mean that more more people will be tested and/or existing testing regimes will be performed more frequently.

Cellestis - Changing the way the world looks at TB.

Monday, March 22, 2010

USA TB Testing of Foreign Born Persons.

The following was uncovered and reported by "doc-gt" over here. I am re-reporting the essence of it because it is very important.

The (US) Advisory Council for the Elimination of TB (ACET) is convened by the CDC with the specific purpose of advising the CDC. Their meetings are open to the public and the minutes of their meetings are publicly published. The most recent minutes (October 2009) are available here.

There is a lot of information in the minutes but of particular interest is the Update by the Foreign-Born Working Group (FBWG) starting at page 19. The FBWG is tasked with revising the "Recommendations for Prevention and Control of Tuberculosis Among Foreign-Born Persons".

It seems to be clearly accepted that the current processes are not working - while TB prevalence rates in the general US population are decreasing, the rates amongst the Foreign Born Persons (FBPs) are increasing.

Reading previous minutes, it is clear that there has been much discussion on how these problems should be managed. It is only in these minutes that a full consensus has been arrived at.

Putting all of that together they are saying that all FBPs (except for the Western Europeans, Canadians and Australians) should be tested for Latent TB and the preferred method for doing this is the IGRA.

According to the minutes there are currently 6.9m FBPs with Latent TB in the US.

If we add this recommendation to our best intelligence of the shortly forthcoming CDC Guidelines we now have:

IGRA diagnosis is preferred for:

- those who have been BCG vaccinated.

- those who are likely to not return for reading of a TST.

- those who are at low risk of TB

- all Foreign Born Persons.

If we further assume that Health care Workers will be tested with IGRA (a not unreasonable assumption) then there isn't much left! It seems that Dr. Masae Kawamurra's prediction of the TST fading into a very minor role is very likely to come true.

The (US) Advisory Council for the Elimination of TB (ACET) is convened by the CDC with the specific purpose of advising the CDC. Their meetings are open to the public and the minutes of their meetings are publicly published. The most recent minutes (October 2009) are available here.

There is a lot of information in the minutes but of particular interest is the Update by the Foreign-Born Working Group (FBWG) starting at page 19. The FBWG is tasked with revising the "Recommendations for Prevention and Control of Tuberculosis Among Foreign-Born Persons".

It seems to be clearly accepted that the current processes are not working - while TB prevalence rates in the general US population are decreasing, the rates amongst the Foreign Born Persons (FBPs) are increasing.

"CDC acknowledged the need for a new approach to TB control in FBPs because the two most broadly implemented strategies have not significantly impacted the incidence of TB among FBPs."

"Most foreignborn TB cases are due to reactivation of infection acquired prior to arrival to the United States. The 6.9 million FBPs with LTBI must be addressed to achieve TB elimination."

Reading previous minutes, it is clear that there has been much discussion on how these problems should be managed. It is only in these minutes that a full consensus has been arrived at.

"One, what FBPs should be screened? The consensus panel agreed that each individual born in a TB-endemic country should be screened at least once for LTBI.

This recommendation would include all persons born in every foreign country with the exception of Australia, Canada and Western Europe."and

"Two, what methods should be implemented to screen FBPs? The consensus panel agreed that IGRAs are the preferred screening method for most FBPs due to their higher specificity in persons who have received BCG vaccination."

Putting all of that together they are saying that all FBPs (except for the Western Europeans, Canadians and Australians) should be tested for Latent TB and the preferred method for doing this is the IGRA.

According to the minutes there are currently 6.9m FBPs with Latent TB in the US.

If we add this recommendation to our best intelligence of the shortly forthcoming CDC Guidelines we now have:

IGRA diagnosis is preferred for:

- those who have been BCG vaccinated.

- those who are likely to not return for reading of a TST.

- those who are at low risk of TB

- all Foreign Born Persons.

If we further assume that Health care Workers will be tested with IGRA (a not unreasonable assumption) then there isn't much left! It seems that Dr. Masae Kawamurra's prediction of the TST fading into a very minor role is very likely to come true.

Sunday, March 21, 2010

More on Marketing and Selling.

I've been thinking some more about this topic.

Any of us that have been following the Cellestis story for any length of time are fully aware (and probably at times frustrated) that the evidence is clearly available that QuantiFERON-TB Gold provides a superior diagnostic method for TB infection with enormous benefits for TB control, patients and society, yet the uptake to date has been only modest. I guess it is easy to come up with all sorts of pejorative reasons why this is so, but if we really want to find the reasons we need to more closely examine the controlling factors and dynamics of the market.

TB disease has been with the human race for thousands of years and has been seriously managed by the medical profession for over one hundred years. Much has been achieved in those 100 years - we now have a reasonable understanding of TB, we have diagnostics for TB and we have treatments for TB. None of this is perfect but it is at least something. It's a positive that we have made this progress. However, with that positive comes some negatives.

Cellestis have a stated aim of "Changing the way the world looks at TB". That's a huge undertaking.

Let's look at a different situation. What are the dynamics when a previously unknown disease strikes? We don't even need to guess at how this is dealt with. In recent decades there have been a number of such events that have been managed with greater or lesser success, HIV, bird flu, H1N1. When these diseases strike, we (the human race) start with a blank slate and apply our not insubstantial resources to understanding the disease and developing diagnostic and treatment protocols. In the first instance our answers may be imperfect but each answer is usually better than the last and over a relatively short period of time we become better at dealing with the disease. Everybody understands and accepts this process. Everybody from the most elite research scientists through to the "coal face" practitioners accepts the dynamism of that situation and adopts improved practices very rapidly.

TB is different purely because it has such a long medical history. In that time a huge amount of research has been performed and practices have become entrenched. These practices have worked, to the extent that the human race has not been wiped out by TB. These practices have become enshrined in legislation, guidelines and in the knowledge of TB practitioners. Very few practitioners are going to step outside that structure. That is both understandable and wise.

To change that situation is a long and arduous task. Many common perceptions need to be challenged. Our medical system, that is rightly designed to protect us, requires huge amounts of real evidence before it changes. In the specific field (in this case TB diagnostics) the new findings must be justified against all previous findings - often this is a case of actually integrating the new knowledge into the old in a logical and correct manner. The new knowledge may not only extend upon previous knowledge but also explain previously unexplained data. It may even refute previous understandings or assumptions. Every step of this course must be negotiated in the correct academic and medical way. At first glance, to laymen like myself it seems incredibly tedious and long winded. It may even be that in some instances it is. However the challenges in changing that whole system to one which can progress more quickly but still provides the required protections would make the challenge of implementing a new TB diagnostic seem minuscule in comparison.

In short, it seems to me that Cellestis had no choice but to embark upon this road some ten years ago (back in the days when I was sprightly youngster with no grey hairs). That is why, no doubt, they embarked upon the much discussed "top down" approach to this. That is, allowing and assisting the researchers to investigate the diagnostic to their own satisfaction, then gaining legislative approval (FDA) and finally the medical authority stamp of approval (CDC). Of course it is not quite as clear cut and sequential as the above might imply but you get the idea. It is only when all of that is in place can you really commence the actual aggressive selling of QuantiFERON-TB Gold into the market with the level of success that is inevitable.

We are almost there!

Cellestis have done an amazing job of negotiating this path while, at the same time, husbanding their quite modest financial resources and, even more amazingly, making enough sales to turn a respectable profit.

In my opinion the new CDC guidelines that will be released "very shortly" are the last major piece of the puzzle. If what Dr. Masae Kawamura has presented is indeed correct (and there is no reason to believe it is not - it is backed up by other sources) then all the significant shackles to sales success (in the USA - the rest of the world to follow) have been removed.

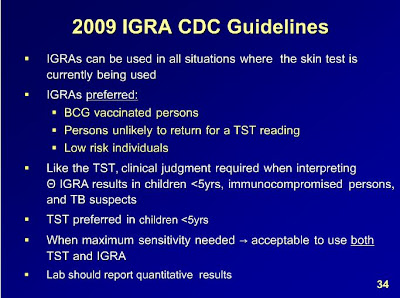

In simple terms, it seems that the new CDC guidelines allow the use of QuantiFERON as the TB diagnostic in every single situation that you might want to diagnose TB. The one and only caution is that they retain a preference that children under 5 year old be tested with TST. No doubt as more trial results become available, even this will be changed.

More importantly (according to Dr Kawamura), the QFT diagnostic is preferred in what amounts to the majority of testing scenarios. (I will personally be interested to see if the guidelines make any specific reference to HCW testing)

We are not at the end of the road. We are now just approaching "the end of the beginning". With the release of this guideline, Cellestis will be able to implement a powerful sales push directly to the absolute market coal face. It is going to be an exciting time.

Addendum: Make sure that you read this over here on Rogs Blog.

Any of us that have been following the Cellestis story for any length of time are fully aware (and probably at times frustrated) that the evidence is clearly available that QuantiFERON-TB Gold provides a superior diagnostic method for TB infection with enormous benefits for TB control, patients and society, yet the uptake to date has been only modest. I guess it is easy to come up with all sorts of pejorative reasons why this is so, but if we really want to find the reasons we need to more closely examine the controlling factors and dynamics of the market.

TB disease has been with the human race for thousands of years and has been seriously managed by the medical profession for over one hundred years. Much has been achieved in those 100 years - we now have a reasonable understanding of TB, we have diagnostics for TB and we have treatments for TB. None of this is perfect but it is at least something. It's a positive that we have made this progress. However, with that positive comes some negatives.

Cellestis have a stated aim of "Changing the way the world looks at TB". That's a huge undertaking.

Let's look at a different situation. What are the dynamics when a previously unknown disease strikes? We don't even need to guess at how this is dealt with. In recent decades there have been a number of such events that have been managed with greater or lesser success, HIV, bird flu, H1N1. When these diseases strike, we (the human race) start with a blank slate and apply our not insubstantial resources to understanding the disease and developing diagnostic and treatment protocols. In the first instance our answers may be imperfect but each answer is usually better than the last and over a relatively short period of time we become better at dealing with the disease. Everybody understands and accepts this process. Everybody from the most elite research scientists through to the "coal face" practitioners accepts the dynamism of that situation and adopts improved practices very rapidly.

TB is different purely because it has such a long medical history. In that time a huge amount of research has been performed and practices have become entrenched. These practices have worked, to the extent that the human race has not been wiped out by TB. These practices have become enshrined in legislation, guidelines and in the knowledge of TB practitioners. Very few practitioners are going to step outside that structure. That is both understandable and wise.

To change that situation is a long and arduous task. Many common perceptions need to be challenged. Our medical system, that is rightly designed to protect us, requires huge amounts of real evidence before it changes. In the specific field (in this case TB diagnostics) the new findings must be justified against all previous findings - often this is a case of actually integrating the new knowledge into the old in a logical and correct manner. The new knowledge may not only extend upon previous knowledge but also explain previously unexplained data. It may even refute previous understandings or assumptions. Every step of this course must be negotiated in the correct academic and medical way. At first glance, to laymen like myself it seems incredibly tedious and long winded. It may even be that in some instances it is. However the challenges in changing that whole system to one which can progress more quickly but still provides the required protections would make the challenge of implementing a new TB diagnostic seem minuscule in comparison.

In short, it seems to me that Cellestis had no choice but to embark upon this road some ten years ago (back in the days when I was sprightly youngster with no grey hairs). That is why, no doubt, they embarked upon the much discussed "top down" approach to this. That is, allowing and assisting the researchers to investigate the diagnostic to their own satisfaction, then gaining legislative approval (FDA) and finally the medical authority stamp of approval (CDC). Of course it is not quite as clear cut and sequential as the above might imply but you get the idea. It is only when all of that is in place can you really commence the actual aggressive selling of QuantiFERON-TB Gold into the market with the level of success that is inevitable.

We are almost there!

Cellestis have done an amazing job of negotiating this path while, at the same time, husbanding their quite modest financial resources and, even more amazingly, making enough sales to turn a respectable profit.

In my opinion the new CDC guidelines that will be released "very shortly" are the last major piece of the puzzle. If what Dr. Masae Kawamura has presented is indeed correct (and there is no reason to believe it is not - it is backed up by other sources) then all the significant shackles to sales success (in the USA - the rest of the world to follow) have been removed.

In simple terms, it seems that the new CDC guidelines allow the use of QuantiFERON as the TB diagnostic in every single situation that you might want to diagnose TB. The one and only caution is that they retain a preference that children under 5 year old be tested with TST. No doubt as more trial results become available, even this will be changed.

More importantly (according to Dr Kawamura), the QFT diagnostic is preferred in what amounts to the majority of testing scenarios. (I will personally be interested to see if the guidelines make any specific reference to HCW testing)

We are not at the end of the road. We are now just approaching "the end of the beginning". With the release of this guideline, Cellestis will be able to implement a powerful sales push directly to the absolute market coal face. It is going to be an exciting time.

Addendum: Make sure that you read this over here on Rogs Blog.

Saturday, March 20, 2010

The Lowdown.

Dr. Masae Kawamura is the TB Controller for San Francisco. She recently made this presentation for the Francis J Curry National Tuberculosis Center.

It is well worth watching (turn your sound on) if you are interested in understanding why and how QuantiFERON testing is progressively replacing TST testing. If you want to save yourself a little time, start at slide 22.

Slide 34 is particularly interesting as it gives strong hints as to what the new CDC Guidelines will contain.

It is well worth watching (turn your sound on) if you are interested in understanding why and how QuantiFERON testing is progressively replacing TST testing. If you want to save yourself a little time, start at slide 22.

Slide 34 is particularly interesting as it gives strong hints as to what the new CDC Guidelines will contain.

Canada. (Inuit).

A couple of interesting articles that I have come across.

Firstly, it is good to see the recognition that monitoring of Latent TB is an important part of an effective TB control program.

However, it strikes me that this particular circumstance presents some interesting logistical challenges.

How would you use the TST to monitor Latent TB in these remote populations. Would you fly a TB Nurse into these communities to place the TST and then hang around for 3 days to take the reading? Or would you fly the Inuits to Goose Bay, place the test and have them wait for 3 days to have their TST read?

In all likelihood, neither of those scenarios make any sense at all. Not forgetting that at the end of that process you will only get a flawed diagnosis anyway.

It is quite likely it makes much more sense to take a blood sample on-site from the patients and fly it back to the nearest lab for processing. I would imagine that there may even be other blood tests, in addition to the far more accurate QuantiFERON-TB, that could be performed at the same time.

I realize that from a commercial point of view this is a tiny market. However, we must never forget that the more accurate results produced by QFT are not only about making money but also about achieving better outcomes for patients.

Tuberculosis Strikes Hard Among Canada's Inuit

Agence France Presse, March 10, 2010

From 2004 to 2008, TB rates among Canada’s Inuit increased from 80.4 cases per 100,000 people to 157.5, even as TB prevalence declined in the general population, an Inuit advocacy group said Wednesday. New TB cases among Canada’s Inuit, who number 50,000, doubled during the period, from 41 to 88, according to federal surveillance data cited by the Inuit Tapiriit Kanatami (ITK). Aggravating factors include the vast, desolate remoteness of Canada’s far north. Only one hospital serves all 26 communities in the Nunavut territory, which is about the size of France or Texas. It also lacks enough staff coverage, said Gail Turner of ITK. “In Nunatsiavut, where I live, Inuit must fly to Goose Bay to receive a chest X-ray,” said Turner. “Recently, that meant a group of patients was stranded for 15 days because of weather.” Poverty is exacerbated due to the high price of imported foods, while local hunting has been made more dangerous by the disappearing ice cover. Entire extended families sometimes live in single-room houses - ideal conditions for TB transmission. These unique community characteristics make TB diagnosis and control difficult, said Turner. “Tuberculosis is challenging because there’s a perception that it’s gone,” she said. “It is imperative that a separate strategy be created now for Inuit,” Turner said. “TB will never be eliminated until housing is improved, food security is improved, and access to health care for Inuit is closer to what other Canadians take for granted.”and

Latent TB Needs Monitoring in Inuit Patients: ITK (Canada)

CBC News, www.cbc.ca, March 15, 2010

Although the problem of active TB disease among the Inuit is being monitored by health officials, Inuit Tapiriit Kanatami’s National Inuit Committee on Health is requesting that more attention be paid to latent TB infection (LTBI). Gail Turner, chairperson of the committee noted that although people with LTBI are not sick, they are at risk of developing active TB disease, and tracking them is just as important as tracking those with active disease. The Nunavut’s Health Department also wants attention paid to the issue of LTBI. At present, the health department screens high-risk groups, and some of these people receive drug treatment, but it is not clear what percentage complete the treatment. Approximately 98 percent of patients with active TB disease in the territory complete their treatment. Dr. Isaac Sobol, Chief Medical Officer of Health for Nunavut, stated that a new electronic recording system would be helpful to better track LTBI patients. The department felt that there is a 10 percent chance of persons with LTBI developing active TB disease; however, that statistic applies to patients who are vigilant with their care and nutrition. According to Turner, Inuit health care and nutrition levels are below those in other parts of Canada. Turner felt that more of the people with LTBI could develop active TB disease over time, and she did not want them to fall through the system; hence, the importance of keeping in touch with persons with LTBI.

Firstly, it is good to see the recognition that monitoring of Latent TB is an important part of an effective TB control program.

However, it strikes me that this particular circumstance presents some interesting logistical challenges.

How would you use the TST to monitor Latent TB in these remote populations. Would you fly a TB Nurse into these communities to place the TST and then hang around for 3 days to take the reading? Or would you fly the Inuits to Goose Bay, place the test and have them wait for 3 days to have their TST read?

In all likelihood, neither of those scenarios make any sense at all. Not forgetting that at the end of that process you will only get a flawed diagnosis anyway.

It is quite likely it makes much more sense to take a blood sample on-site from the patients and fly it back to the nearest lab for processing. I would imagine that there may even be other blood tests, in addition to the far more accurate QuantiFERON-TB, that could be performed at the same time.

I realize that from a commercial point of view this is a tiny market. However, we must never forget that the more accurate results produced by QFT are not only about making money but also about achieving better outcomes for patients.

Thursday, March 18, 2010

Tweet.

Now I can't really say that I fully understand the Twitter thing. I understand the basic idea but for somebody as long winded as me, I don't believe that I can convey anything of value in 140 characters.

However, I think I have found one good use for it. If I have pressed the right buttons and ticked the right boxes then anybody that is "following" me on twitter will get a "tweet" (sigh) immediately that I post anything on this blog.

So, feel free to follow me on Twitter where I am known as ForrestThinks.

However, I think I have found one good use for it. If I have pressed the right buttons and ticked the right boxes then anybody that is "following" me on twitter will get a "tweet" (sigh) immediately that I post anything on this blog.

So, feel free to follow me on Twitter where I am known as ForrestThinks.

More Statistics.

While we are talking about statistics, I will raise a point that I touched on in an earlier post.

As soon as you start researching TB you will, no doubt, trip across the following two widely quoted statistics.

- 30% of the world population is infected with latent TB.

- The lifetime risk of latent TB becoming active is 10%.

So, (ignoring geographic distribution of TB) the above statistics when taken together would indicate that of a group of 1000 people, 300 would be infected with latent TB and 30 of them would progress to active TB during their lives.

But, let's just look at that a little closer. How were those figures arrived at?

We can probably assume that the total number of active TB cases in any year can be reasonably correctly arrived at. However, how do we know that 30% of the world is infected with latent TB? There is no gold standard for diagnosing latent infection. Until the arrival of QuantiFERON-TB the only diagnostic available for latent TB was the TST. You may remember that the TST has an exceptionally poor specificity (ie it reports many false positives). This is largely due to it's inability to differentiate between past infection and BCG vaccination vs true current latent infection. It is not unreasonable to presume, therefore, that the percentage of people infected with latent TB is a lot less than 30%.

What happens if the correct figure is 15%?

That would mean that of our group of 1000 people, 150 would be infected with latent TB and 30 of those would contract active TB during their life.

That changes our second statistic to read: The lifetime risk of a latent TB infection becoming active is 20%. It's getting scarier, isn't it?

What if the worldwide rate of TB infection is even lower? 15%? 10%? 5%?

Suddenly the whole picture looks a lot different, doesn't it? Spelling it out, the higher the true conversion rate (from latent to active), the more useful, cost effective and imperative it becomes to test for and treat latent TB.

Recent trials, studies and findings (eg Halder et al) are indicating that the scenario that I have painted above is true. It is becoming clear that the "predictive value" of QFT is several times that of TST. i.e. If you are diagnosed with latent TB by QFT your chance of progressing to active TB is much higher than if you are diagnosed with latent TB by TST. This is not because QFT is finding "a different sort of TB", it is purely due to the fact that TST is reporting as positive a whole raft of people who did not actually have TB in the first place whereas QFT is reporting true infection.

The conclusion of all of the above is obvious. Not only can we rely on QFT to more correctly identify latent TB infection than with TST but the whole diagnostic imperative changes with a switch to QFT testing. It now becomes a worthwhile (and necessary) exercise to test more of the population.

The medical system is driven by many forces - one of them is effective use of limited resources, including money. Given that, it is not hard to see that if a diagnostic has a low predictive value then it becomes less likely that mass screening with that diagnostic is a resource effective solution to a problem. Remember the saying in the TB fraternity - "A decision to test is a decision to treat". Treating a whole lot of people that do not actually have TB is both a waste of resources and, from the patients point of view, an unnecessary evil. If, on the other hand, you have a diagnostic with a much higher predictive value then the dynamics of TB control change quite dramatically. Suddenly, screening of population groups becomes a viable control mechanism.

Once the above becomes accepted as fact (and the evidence is appearing right now) then it is quite likely that we will see a re-shaping of TB control policies in the developed world to include more population groups being screened.

As soon as you start researching TB you will, no doubt, trip across the following two widely quoted statistics.

- 30% of the world population is infected with latent TB.

- The lifetime risk of latent TB becoming active is 10%.

So, (ignoring geographic distribution of TB) the above statistics when taken together would indicate that of a group of 1000 people, 300 would be infected with latent TB and 30 of them would progress to active TB during their lives.

But, let's just look at that a little closer. How were those figures arrived at?

We can probably assume that the total number of active TB cases in any year can be reasonably correctly arrived at. However, how do we know that 30% of the world is infected with latent TB? There is no gold standard for diagnosing latent infection. Until the arrival of QuantiFERON-TB the only diagnostic available for latent TB was the TST. You may remember that the TST has an exceptionally poor specificity (ie it reports many false positives). This is largely due to it's inability to differentiate between past infection and BCG vaccination vs true current latent infection. It is not unreasonable to presume, therefore, that the percentage of people infected with latent TB is a lot less than 30%.

What happens if the correct figure is 15%?

That would mean that of our group of 1000 people, 150 would be infected with latent TB and 30 of those would contract active TB during their life.

That changes our second statistic to read: The lifetime risk of a latent TB infection becoming active is 20%. It's getting scarier, isn't it?

What if the worldwide rate of TB infection is even lower? 15%? 10%? 5%?

Suddenly the whole picture looks a lot different, doesn't it? Spelling it out, the higher the true conversion rate (from latent to active), the more useful, cost effective and imperative it becomes to test for and treat latent TB.

Recent trials, studies and findings (eg Halder et al) are indicating that the scenario that I have painted above is true. It is becoming clear that the "predictive value" of QFT is several times that of TST. i.e. If you are diagnosed with latent TB by QFT your chance of progressing to active TB is much higher than if you are diagnosed with latent TB by TST. This is not because QFT is finding "a different sort of TB", it is purely due to the fact that TST is reporting as positive a whole raft of people who did not actually have TB in the first place whereas QFT is reporting true infection.

The conclusion of all of the above is obvious. Not only can we rely on QFT to more correctly identify latent TB infection than with TST but the whole diagnostic imperative changes with a switch to QFT testing. It now becomes a worthwhile (and necessary) exercise to test more of the population.

The medical system is driven by many forces - one of them is effective use of limited resources, including money. Given that, it is not hard to see that if a diagnostic has a low predictive value then it becomes less likely that mass screening with that diagnostic is a resource effective solution to a problem. Remember the saying in the TB fraternity - "A decision to test is a decision to treat". Treating a whole lot of people that do not actually have TB is both a waste of resources and, from the patients point of view, an unnecessary evil. If, on the other hand, you have a diagnostic with a much higher predictive value then the dynamics of TB control change quite dramatically. Suddenly, screening of population groups becomes a viable control mechanism.

Once the above becomes accepted as fact (and the evidence is appearing right now) then it is quite likely that we will see a re-shaping of TB control policies in the developed world to include more population groups being screened.

Wednesday, March 17, 2010

A Statistical Misunderstanding.

It is often quoted that a person needs to spend a significant amount of time in close proximity to a person with active TB to contract TB themselves. Even more specifically, it seems to be "common knowledge" (the worst sort of knowledge, in my opinion) that you would need to be on an plane for eight (8) hours with a TB sufferer to contract TB.

What seems to be overlooked is that that is a pure statistical calculation. Just as it doesn't mean that you will definitely contract TB after eight hours and one minute, it doesn't mean that you definitely won't contract TB after 7 hours and fifty-nine minutes.

It doesn't take a lot of logical thought to realize that, whilst the statistic is, perhaps, verifiable as having a statistical meaning, the conclusion being implied and drawn from the statistic is misleading. It actually implies some form of TB infection mechanism that is quite untrue. It implies some vague concept that the TB bacteria that you breath in is safe up to a certain level, after which you will contract TB (a type of "tipping point"). The truth is that the only way you can be sure that you will not contract TB is not breathe in a single TB bacterium. It is therefore quite possible that you could contract TB within the first minute of exposure. The longer the exposure lasts, the more likely you are to breath in a TB bacterium and contract TB.

Implementing a policy of only screening people who have spent eight hours in close proximity may make some sort of sense in the allocation of (all too small) TB medical resources but it does not guarantee the individual person that the system is protecting them from TB infection.

What seems to be overlooked is that that is a pure statistical calculation. Just as it doesn't mean that you will definitely contract TB after eight hours and one minute, it doesn't mean that you definitely won't contract TB after 7 hours and fifty-nine minutes.

It doesn't take a lot of logical thought to realize that, whilst the statistic is, perhaps, verifiable as having a statistical meaning, the conclusion being implied and drawn from the statistic is misleading. It actually implies some form of TB infection mechanism that is quite untrue. It implies some vague concept that the TB bacteria that you breath in is safe up to a certain level, after which you will contract TB (a type of "tipping point"). The truth is that the only way you can be sure that you will not contract TB is not breathe in a single TB bacterium. It is therefore quite possible that you could contract TB within the first minute of exposure. The longer the exposure lasts, the more likely you are to breath in a TB bacterium and contract TB.

Implementing a policy of only screening people who have spent eight hours in close proximity may make some sort of sense in the allocation of (all too small) TB medical resources but it does not guarantee the individual person that the system is protecting them from TB infection.

Sunday, March 14, 2010

Tipping Point.

Over the last couple of years the concept of a tipping point has been frequently discussed. Simply, the tipping point is the level at which the momentum for change becomes unstoppable. Given that Cellestis, with it's QuantiFERON product, is attempting to change the way that the world diagnoses Tuberculosis this concept has significant relevance to us. With a current total market penetration of less than 4% of a total estimated market of 50m tests per annum, we have enormous scope for growth. Our faith is that at some time we will reach that tipping point and our sales volumes will spike to much higher levels.

When we apply the concept of a tipping point to this specific market we are really looking at the phenomenon of current sales influencing future sales. This is particularly so in the medical field, where change is slow and considered but once made is made with a justifiable commitment and belief. I (and probably everybody else) don't know exactly what the tipping point is expressed as a percentage of market. Consensus seems to be that it may be around 10% to 15% of the market. In truth, nobody really knows - all we know is that there will be a tipping point.

Again, looking at our current worldwide market penetration of less than 4% both evidentially and mathematically we would have to say that we have not yet reached that worldwide tipping point. However, let's look at the market in a little more depth.

Every country in the world has different rates of TB, different TB resources and different budgetary considerations. Each country has different authoritative recommendations, guidelines and law which, in the end, will determine how that country will implement a new diagnostic regime based around QuantiFERON. There will also be an influence effect - as more countries accept and adopt QFT, other countries will be more inclined to embrace the technology. It goes without saying that the U.S. is a major leader in this.

We can break that country by country division of the market down further. Within each country there are several different classifications of TB testing performed - they might be Contact Tracing, Immigrant testing, Health Care Worker testing, Military testing, International Student testing and Population Screening. Typically, the authorities address each of these groups individually in their guidelines. Again each of these broad brush customers will influence the others.

Having assembled that picture above it is my conclusion that the most important market for Cellestis to penetrate is the US Health Care Worker (HCW) market. The successful achievement of domination in this market will lead to a consequential "toppling of the dominoes" through the rest of the US market and the world. Therefore, reaching the "tipping" point in this one market will be a huge step towards a worldwide tipping point.

Some of the reasons why the US HCW market is a driving force.

- This market is, by definition, largely composed of medical personnel.Their exposure to this diagnostic in this way builds their faith and confidence in using the test for others.

- In putting in place the resources and procedures for performing the diagnostic for themselves, they are putting in place the same resources and procedures needed to test others.

- Patients are unlikely to accept an antiquated and inaccurate diagnostic for themselves if they know that their medical practitioner is using a better diagnostic themselves.

So, where exactly is Cellestis at in this market subset?

As of 2006 there were approximately 14m HCWs in the US. That figure would be higher now, not only because the number of HCWs has increased but also because there has been a tendency for the definition of HCW (for TB testing purposes) to be widened to include ancillary staff in hospitals and medical facilities. The CDC has implemented TB screening for HCW's based upon a risk assessment of individual medical facilities, employee roles and employee history. To date, I have been unable to translate this requirement directly into a specific number of tests conducted each year. Hopefully, in time, this will become a little clearer. However, taking into account new hires, the various cycles of testing mandated by the CDC and the growing awareness of TB, I estimate that somewhere between 3m and 4m HCW TB tests are conducted each year in the US.

What we do know, however, is that as of the end of the 2009 FY, Cellestis stated that they have approximately 10% of the US HCW market. We can only assume that this percentage has grown subsequently. Have we reached the "tipping point" in this crucial market? Probably not. But we must be very close.

-

When we apply the concept of a tipping point to this specific market we are really looking at the phenomenon of current sales influencing future sales. This is particularly so in the medical field, where change is slow and considered but once made is made with a justifiable commitment and belief. I (and probably everybody else) don't know exactly what the tipping point is expressed as a percentage of market. Consensus seems to be that it may be around 10% to 15% of the market. In truth, nobody really knows - all we know is that there will be a tipping point.

Again, looking at our current worldwide market penetration of less than 4% both evidentially and mathematically we would have to say that we have not yet reached that worldwide tipping point. However, let's look at the market in a little more depth.

Every country in the world has different rates of TB, different TB resources and different budgetary considerations. Each country has different authoritative recommendations, guidelines and law which, in the end, will determine how that country will implement a new diagnostic regime based around QuantiFERON. There will also be an influence effect - as more countries accept and adopt QFT, other countries will be more inclined to embrace the technology. It goes without saying that the U.S. is a major leader in this.

We can break that country by country division of the market down further. Within each country there are several different classifications of TB testing performed - they might be Contact Tracing, Immigrant testing, Health Care Worker testing, Military testing, International Student testing and Population Screening. Typically, the authorities address each of these groups individually in their guidelines. Again each of these broad brush customers will influence the others.

Having assembled that picture above it is my conclusion that the most important market for Cellestis to penetrate is the US Health Care Worker (HCW) market. The successful achievement of domination in this market will lead to a consequential "toppling of the dominoes" through the rest of the US market and the world. Therefore, reaching the "tipping" point in this one market will be a huge step towards a worldwide tipping point.

Some of the reasons why the US HCW market is a driving force.

- This market is, by definition, largely composed of medical personnel.Their exposure to this diagnostic in this way builds their faith and confidence in using the test for others.

- In putting in place the resources and procedures for performing the diagnostic for themselves, they are putting in place the same resources and procedures needed to test others.

- Patients are unlikely to accept an antiquated and inaccurate diagnostic for themselves if they know that their medical practitioner is using a better diagnostic themselves.

So, where exactly is Cellestis at in this market subset?

As of 2006 there were approximately 14m HCWs in the US. That figure would be higher now, not only because the number of HCWs has increased but also because there has been a tendency for the definition of HCW (for TB testing purposes) to be widened to include ancillary staff in hospitals and medical facilities. The CDC has implemented TB screening for HCW's based upon a risk assessment of individual medical facilities, employee roles and employee history. To date, I have been unable to translate this requirement directly into a specific number of tests conducted each year. Hopefully, in time, this will become a little clearer. However, taking into account new hires, the various cycles of testing mandated by the CDC and the growing awareness of TB, I estimate that somewhere between 3m and 4m HCW TB tests are conducted each year in the US.

What we do know, however, is that as of the end of the 2009 FY, Cellestis stated that they have approximately 10% of the US HCW market. We can only assume that this percentage has grown subsequently. Have we reached the "tipping point" in this crucial market? Probably not. But we must be very close.

-

Thursday, March 11, 2010

Forrest makes a boo boo.

It has just been pointed out to me that there was an error in my projection spreadsheet. In the DCF calculations I was using the EPS, rather than the DPS.

Humble apologies. A corrected spreadsheet is here.

Humble apologies. A corrected spreadsheet is here.

The Cellestis Story. Part Four.

(see, I haven't forgotten).

By now I hope you have read The Cellestis Story Part One, The Cellestis Story Part Two and The Cellestis Story Part Three. In those posts I have tried to explain what it is that Cellestis are selling - basically a really cool diagnostic method and specifically, initially, a diagnostic for Tuberculosis. Furthermore, unlike so many other "great ideas on the laboratory bench", we have seen that this technology is scientifically proven by totally independent research.

However, from our point of view as investors, having a great product is only a very small part of the real story of building a successful business. After all, you and I are most likely not invested in CST to further our knowledge of immunology (as interesting as that may be). We are here to make money - at least I am and I assume that the same applies to you. Somewhere, there is a garbage dump full of the carcasses of biotech startups that had seemingly great ideas or products but, in the end, did not reward the investors for their faith (and cash). There are many reasons for their failure. One is the fact that the old saying "Invent a better mousetrap and the world will beat a path to your door" very rarely stands up in reality. I will be discussing how Cellestis have avoided this and the other perils of being a biotech startup in this post.

One (among many) of the reasons that I was impressed with this company right from the beginning was the very clear and incontrovertible statement that they made - "Our intention is to build a worldwide diagnostic business". I suspect that many other biotechs, knowing of the multi year path to commercialization actually have quite a different intent. Their intent is to bring their product to the attention of a multi-national pharmaceutical (or similar) company and then sell out or joint venture for a quick profit. Now that may be all well and good and may indeed turn a good profit but it is a one time, short term approach. As an investor, I see myself as part owner of the companies that I invest in. If I invest in a small startup like Cellestis then I have done so because I believe that, one day, I will be owner of a slice of a large, successful business.

To date, Cellestis have stuck to their guns. They have taken what appears to be the hard road of independently moving their product from the laboratory bench all the way through to commercialization. Somewhat miraculously, they have done this on a total budget of around $20m. Doing it independently and on a realistic budget means an enormous amount to us, the investors. Had they climbed into bed with a "big pharma", you can bet your bottom dollar that your share of the company would now be only a fraction of what it is today. Had they spent their budget unwisely (huge salaries for themselves, a huge chrome and glass edifice to their egos ...) then we would have seen multiple capital raisings over the years that, again, would have diluted our share of the significant profits that are, now, just over the next rise. As it is, the modest capital raising that the company undertook diluted our holdings by less than 10%. The total number of shares and options on issue today are less than 100m. With early profits now happening there is no reason to suspect that our slice of the company will be diluted in the future.

In comparison, there are many startups that have tripled the number of shares on issue before they reach commercialization - if they ever do.

So, what have they achieved in nine years with $20m?

In my post To Market, To Market I discussed a good part of this achievement from the perspective of actually getting their product into the market.

But even that is not enough to "make" a successful company. In fact, the way I look at it, a "company" is only a structure around something that is far more important - a business. It is relatively easy to fashion a company - that means nothing without a viable business that operates within that company to actually generate the ultimate aim - profits. This may seem an extraordinarily obvious point but one that seems to be sometimes overlooked by participants in the stock market. A great announcement may well move the share price of a company but it is only business profits that will make a "real" company (the sort that I want to own).

So, let's look at the concrete, real things that Cellestis have put together to make a business.

Cellestis have established a worldwide presence, with Cellestis offices in Australia, Germany, USA, Japan and now Singapore. This strategic network supports both direct sales by Cellestis and sales through appointed distributors in most developed (and some less developed) countries. The value of this network cannot be underestimated. It, alone, actually has real value. A global network such as this, with people in place, good local contacts and distribution logistics may even generate standalone income should Cellestis so wish. (I'm not suggesting that this is in their plans but it is certainly an option).

In conjunction with the above global network, Cellestis have established worldwide 24 hr per day technical support services ("follow the sun") for users of the QuantiFERON products anywhere in the world. A particular dictum that I have always taken to heart is that "the best customer is the one you already have". That is, keeping your existing customers is the best path to ultimate success. Understanding and meeting the needs of your existing customers is the way to achieve that. Support, support, support.

A complete manufacturing process is in place. The required raw peptides are manufactured to CST specifications in the USA, and shipped to CST Australia for processing into antigens. The antigens are then shipped to Austria where, under contract, they are coated into the tubes and dispatched to Cellestis for distribution. It is a well controlled process and, we are informed, can easily scale to meet future demand growth.

Cellestis have over 65 employees throughout their worldwide operations. I have been fortunate enough to have met a number of them and am pleased to say that they are not only highly motivated but also express their absolute enjoyment in working in such an exciting and dynamic company.

Obviously, Cellestis also have in place the necessary administrative structures to actually run the business on a day to day and year to year basis. This may seem like a mundane part of a business but without effective ordering, invoicing, and payment systems, no business survives.

A good business is always looking to the future as well as dealing with the present. Cellestis have a dedicated Research and Development team that are continually working on improvements to existing products and the development of future products. Fortunately, the two founding Directors of Cellestis come from scientific research backgrounds - they are unlikely to strangle these operations with constraining budgets.

As you can very clearly see, Cellestis is more than just a great idea. It is a carefully crafted business that is well placed to capitalize on all of the opportunities that will be coming its way. Being already operational (manufacturing, selling, delivering, supporting) at the current modest levels will, no doubt, have enabled this entire business structure to be fine tuned and ready to "take on the world".

I say again that all of the above may seem very obvious and even trite. However, think about it clearly - here is a shiny new business that has been able to put in place everything possible to ensure its future success. This has been quietly and carefully built over nine years on a very modest budget. It is proven. It is sensible. It has the best possible chance of succeeding. Compare this with other small startups listed on the ASX. I'm betting that most of them have not even thought about everything that will need to be put in place to make their business a success. Or if they have they have thought "Well, we'll worry about that later".

Stay Tuned. There is much more of this story to come.

By now I hope you have read The Cellestis Story Part One, The Cellestis Story Part Two and The Cellestis Story Part Three. In those posts I have tried to explain what it is that Cellestis are selling - basically a really cool diagnostic method and specifically, initially, a diagnostic for Tuberculosis. Furthermore, unlike so many other "great ideas on the laboratory bench", we have seen that this technology is scientifically proven by totally independent research.

However, from our point of view as investors, having a great product is only a very small part of the real story of building a successful business. After all, you and I are most likely not invested in CST to further our knowledge of immunology (as interesting as that may be). We are here to make money - at least I am and I assume that the same applies to you. Somewhere, there is a garbage dump full of the carcasses of biotech startups that had seemingly great ideas or products but, in the end, did not reward the investors for their faith (and cash). There are many reasons for their failure. One is the fact that the old saying "Invent a better mousetrap and the world will beat a path to your door" very rarely stands up in reality. I will be discussing how Cellestis have avoided this and the other perils of being a biotech startup in this post.

One (among many) of the reasons that I was impressed with this company right from the beginning was the very clear and incontrovertible statement that they made - "Our intention is to build a worldwide diagnostic business". I suspect that many other biotechs, knowing of the multi year path to commercialization actually have quite a different intent. Their intent is to bring their product to the attention of a multi-national pharmaceutical (or similar) company and then sell out or joint venture for a quick profit. Now that may be all well and good and may indeed turn a good profit but it is a one time, short term approach. As an investor, I see myself as part owner of the companies that I invest in. If I invest in a small startup like Cellestis then I have done so because I believe that, one day, I will be owner of a slice of a large, successful business.

To date, Cellestis have stuck to their guns. They have taken what appears to be the hard road of independently moving their product from the laboratory bench all the way through to commercialization. Somewhat miraculously, they have done this on a total budget of around $20m. Doing it independently and on a realistic budget means an enormous amount to us, the investors. Had they climbed into bed with a "big pharma", you can bet your bottom dollar that your share of the company would now be only a fraction of what it is today. Had they spent their budget unwisely (huge salaries for themselves, a huge chrome and glass edifice to their egos ...) then we would have seen multiple capital raisings over the years that, again, would have diluted our share of the significant profits that are, now, just over the next rise. As it is, the modest capital raising that the company undertook diluted our holdings by less than 10%. The total number of shares and options on issue today are less than 100m. With early profits now happening there is no reason to suspect that our slice of the company will be diluted in the future.

In comparison, there are many startups that have tripled the number of shares on issue before they reach commercialization - if they ever do.

So, what have they achieved in nine years with $20m?

In my post To Market, To Market I discussed a good part of this achievement from the perspective of actually getting their product into the market.

But even that is not enough to "make" a successful company. In fact, the way I look at it, a "company" is only a structure around something that is far more important - a business. It is relatively easy to fashion a company - that means nothing without a viable business that operates within that company to actually generate the ultimate aim - profits. This may seem an extraordinarily obvious point but one that seems to be sometimes overlooked by participants in the stock market. A great announcement may well move the share price of a company but it is only business profits that will make a "real" company (the sort that I want to own).

So, let's look at the concrete, real things that Cellestis have put together to make a business.

Cellestis have established a worldwide presence, with Cellestis offices in Australia, Germany, USA, Japan and now Singapore. This strategic network supports both direct sales by Cellestis and sales through appointed distributors in most developed (and some less developed) countries. The value of this network cannot be underestimated. It, alone, actually has real value. A global network such as this, with people in place, good local contacts and distribution logistics may even generate standalone income should Cellestis so wish. (I'm not suggesting that this is in their plans but it is certainly an option).

In conjunction with the above global network, Cellestis have established worldwide 24 hr per day technical support services ("follow the sun") for users of the QuantiFERON products anywhere in the world. A particular dictum that I have always taken to heart is that "the best customer is the one you already have". That is, keeping your existing customers is the best path to ultimate success. Understanding and meeting the needs of your existing customers is the way to achieve that. Support, support, support.

A complete manufacturing process is in place. The required raw peptides are manufactured to CST specifications in the USA, and shipped to CST Australia for processing into antigens. The antigens are then shipped to Austria where, under contract, they are coated into the tubes and dispatched to Cellestis for distribution. It is a well controlled process and, we are informed, can easily scale to meet future demand growth.

Cellestis have over 65 employees throughout their worldwide operations. I have been fortunate enough to have met a number of them and am pleased to say that they are not only highly motivated but also express their absolute enjoyment in working in such an exciting and dynamic company.

Obviously, Cellestis also have in place the necessary administrative structures to actually run the business on a day to day and year to year basis. This may seem like a mundane part of a business but without effective ordering, invoicing, and payment systems, no business survives.

A good business is always looking to the future as well as dealing with the present. Cellestis have a dedicated Research and Development team that are continually working on improvements to existing products and the development of future products. Fortunately, the two founding Directors of Cellestis come from scientific research backgrounds - they are unlikely to strangle these operations with constraining budgets.

As you can very clearly see, Cellestis is more than just a great idea. It is a carefully crafted business that is well placed to capitalize on all of the opportunities that will be coming its way. Being already operational (manufacturing, selling, delivering, supporting) at the current modest levels will, no doubt, have enabled this entire business structure to be fine tuned and ready to "take on the world".

I say again that all of the above may seem very obvious and even trite. However, think about it clearly - here is a shiny new business that has been able to put in place everything possible to ensure its future success. This has been quietly and carefully built over nine years on a very modest budget. It is proven. It is sensible. It has the best possible chance of succeeding. Compare this with other small startups listed on the ASX. I'm betting that most of them have not even thought about everything that will need to be put in place to make their business a success. Or if they have they have thought "Well, we'll worry about that later".

Stay Tuned. There is much more of this story to come.

Wednesday, March 10, 2010

DCF - Discounted Cash Flow.